近日,Marvell宣布已经完成对Cavium公司的并购,合并后的公司将成为一家专注于基础设施市场的领先半导体厂商,为客户提供行业内在深度和广度方面都无可比拟的存储、处理、网络、无线连接和安全产品组合。

Marvell总裁兼首席执行官Matt Murphy表示:“半导体产业下一波的增长无疑将受到数据经济发展的巨大驱动。人工智能、5G、云端、汽车和边缘计算等应用都需要有高带宽、低功耗和领先的复杂系统芯片等组合优势的工程解决方案。在两家公司合并之后,我们现在可以提供业界领先的IP,广泛的基础设施解决方案组合,以及一支能够应对客户最棘手挑战的创新团队。我们很高兴能够开始新的征程。”

Marvell董事会任命三名新董事

Marvell还宣布,Syed Ali、Brad Buss和Edward Frank博士已被任命为Marvell董事会成员,且在并购完成后立即生效。

Syed Ali是Cavium的联合创始人,自公司于2000年成立以来一直担任其总裁、首席执行官和董事会主席。他曾获得印度海得拉巴的奥斯曼尼亚大学(Osmania University in Hyderabad, India)的电气工程学士学位,以及密歇根大学的硕士学位。

Brad Buss自2016年7月起担任Cavium的董事,他还于2014年至2016年期间担任SolarCity的首席财务官,并于2005年至2014年期间担任Cypress Semiconductor的首席财务官。他目前还是特斯拉汽车(Tesla Motors)和Advance Auto Parts的董事会成员。

Buss先生毕业于麦克马斯特大学(McMaster University),获得经济学学士学位,还获得了温莎大学(University of Windsor)工商管理荣誉学士学位。

Edward Frank博士自2016年7月起担任Cavium的董事。他还作为初创公司Cloud Parity的联合创始人,在2016年9月之前担任其首席执行官。

此前,他在2009年至2013年期间担任苹果公司Macintosh硬件系统工程部副总裁。在加入苹果公司之前,他于1999年至2009年期间曾在博通公司(Broadcom Corporation)工作,担任公司研发副总裁。

Frank博士还是ADI公司和Quantenna公司的董事会成员。他持有斯坦福大学的电气工程学士学位(B.S.E.E.)和电气工程硕士学位(M.S.E.E.),并在卡内基梅隆大学(Carnegie Mellon University)获得计算机科学博士学位。鉴于Frank博士为无线网络产品的开发和商业化做出的贡献,他于2018年当选为美国国家工程院(National Academy of Engineering)院士。

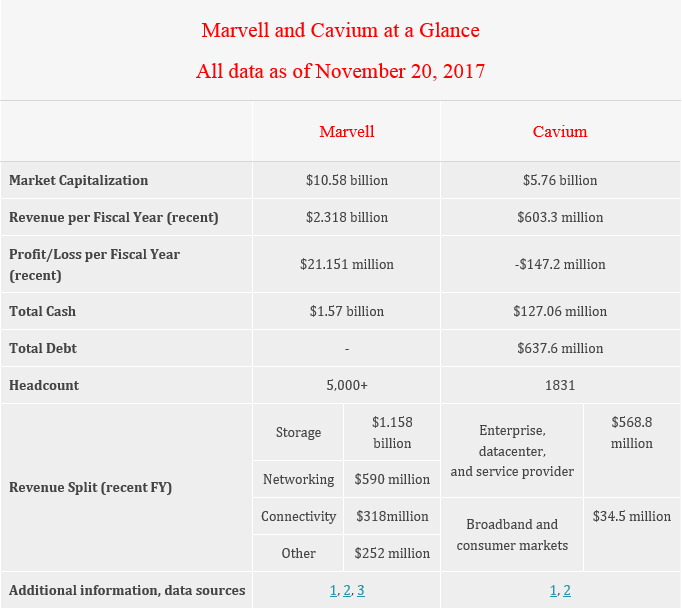

As reported in November, Marvell had tooffer approximately $5.5 billion for outstanding shares of Cavium and absorbCavium’s debt of approximately $637.6 million, which brought the value of thetransaction to over $6.1 billion. For a rather hefty sum of money, Marvellobtained a developer of ARM and MIPS-based SoCs for network, video, security,storage connectivity, server, and other applications. Essentially, the companytransformed itself from a developer of storage controllers (HDD, SSD, RAID,etc.), networking and connectivity solutions into a corporation with a muchgreater potential.

Marvell now pins a lot of hopes on suchapplications as AI, 5G, and Cloud & Edge computing. It is particularlynoteworthy that in its letter to customers, the company even put processingahead of storage when describing its new portfolio of products.

Applications such as AI, 5G, Cloud,automotive, and edge computing all require engineering solutions that combinehigh bandwidth, very low power consumption, and leadership in complex system ona chip solutions,” said Matt Murphy, Marvell’s CEO. “As a combined company, wenow offer industry-leading IP, a broad portfolio of infrastructure solutions,and a talented team of innovators ready to tackle our customers’ toughestchallenges. We’re excited to get started.

As for the actual merger, while the mergeritself was in the planning stages well before it was even announced, in a sensethe company can only now really get started on being a merged entity now thatthe merger has been completed. Due to regulations, companies cannot work reallyclosely (i.e., share confidential information) before the transaction isclosed. As a result, Marvell and Cavium will have to create a new roadmap from scratchin the coming months while talking to their clients and having all the requiredinformation about each other’s capabilities.

Moving on to the impact on employees. Withthe acquisition of Cavium, Marvell’s headcount should have increased to around7000. Meanwhile, in letters to clients and suppliers Marvell’s management saidthat the combined company would employ “5000+” people, roughly the same numberMarvell employed before the takeover. Perhaps Marvell’s execs are toooptimistic about synergies between two companies, and are planning onsignificant layoffs. Obviously, letting almost 30% of the staff go sounds likea rather drastic measure that is going to cost a lot a lot of money. Anotherexplanation is that Marvell does not want certain businesses it now has, sothey will be eventually sold off and the headcount will reduce to 5000+.

Speaking of prospects of the merged companyin general, it remains to be seen whether the “new Marvell” wants to keep allthe business units, but optimize the workforce, or get rid of certainbusinesses. I will repeat what I said back in November:

"In the coming years the expectedserviceable addressable market for CPUs and specialized SoCs will grow. Inparticular, low-power CPUs will be needed for 5G base stations and otheremerging applications. Cavium already has custom ThunderX SoCs for servers andtelecom equipment, so Marvell will need to develop them further to gain in thefuture."

What I can add to this is that computecapabilities are getting increasingly important for storage industry ingeneral. In fact, in-storage processing looks to be gaining traction. SinceMarvell announced plans to acquire Cavium, Western Digital has disclosed plansto use RISC-V cores for all of its products in the coming years and has impliedthat they'll be using in-storage processing. Furthermore, NGD released itssecond-gen Catalina SSD with in-storage processing and is gearing up to releasean ASIC-based Catalina 3 later this year.

Finally, with the closure of the deal,Marvell has also announced that Syed Ali (co-founder and CEO of Cavium), BradBuss (a director of Cavium) and Dr. Edward Frank (a director of Cavium) wouldjoin Marvell’s board of directors.

本文转载自:Marvell